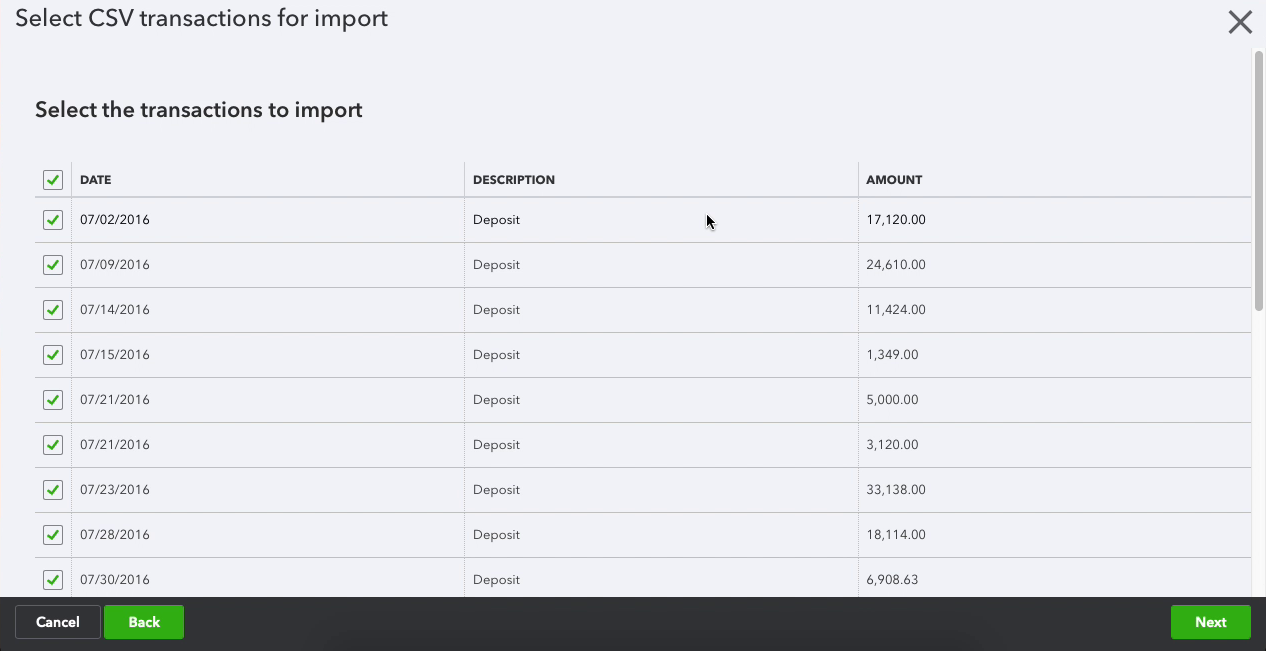

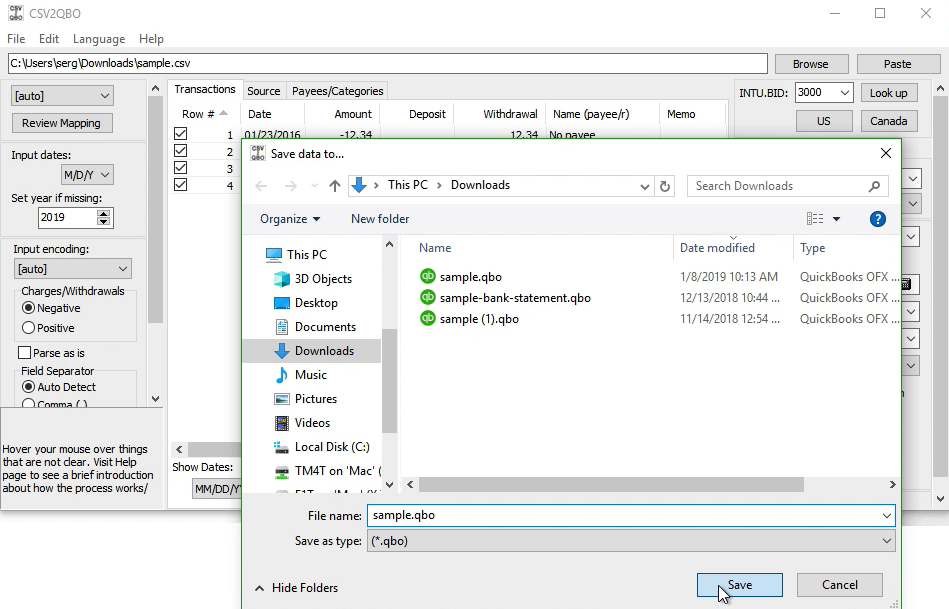

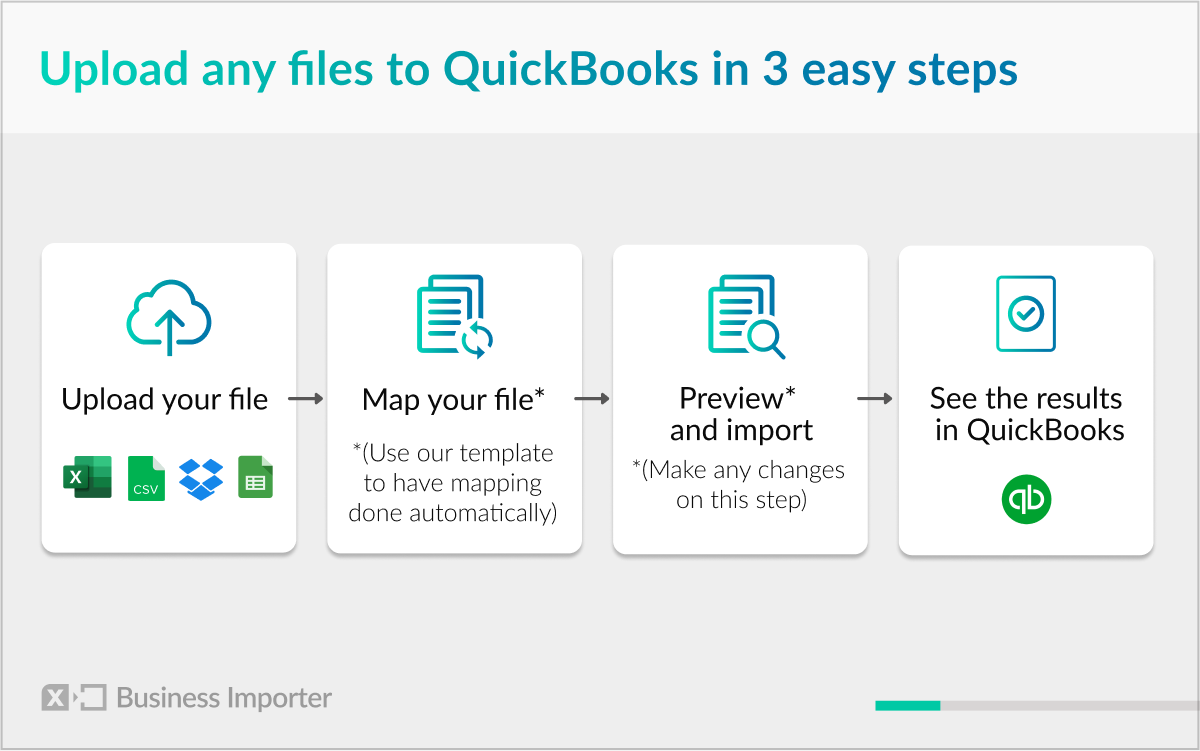

In the "Display" tab, look for the "Columns" window and de-select all defaulted checked items. Select "Customize Report" in upper left corner of the report. Update "Dates" to Last Calendar year for tax year 2022.Ĭhange "Only 1099 Vendors" to "All Vendors" and "Only 1099 Accounts" to "All Allowed Accounts".Īfter generating the report, you may manually delete rows for any vendors with non-reportable payments. Step 3: Cut and paste into our CSV template and import.įrom the upper menu, select Vendors->Print/E-file 1099s->1099 Detail Report Step 2: Edit your QB CSV file to format Vendors suitably to cut and paste into our CSV template. Step 1: Export your 1099-MISC or 1099-NEC info from QB to a CSV file.

Due to changes related to the 1099-NEC, we no longer support direct QB import via web connector.

0 kommentar(er)

0 kommentar(er)